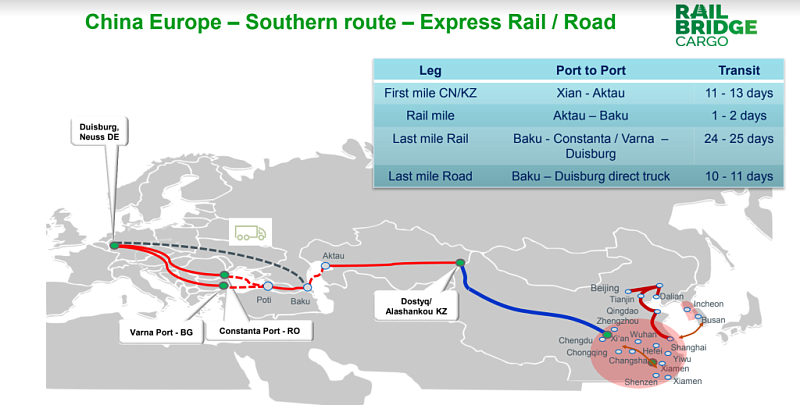

The first is a multimodal journey departing from Chengdu and connecting by rail to the Kazakh port of Aktau. Here, it crosses the Caspian Sea to Baku, for another train ride to the port of Poti. From this Georgian port, vessels take the cargo to the port of Constanta in Romania.

In three weeks time, RailBridge Cargo will also start offering space on the train from Xi’an to Baku via the Caspian Sea, with a truck journey providing the last-mile to Duisburg. The Xian to Duisburg service has a transit time of 25 days.This is the fourth route the Dutch logistics company offers since the outbreak of the war in Ukraine.

Avoiding Russia and Belarus

When the war in Ukraine started, the company reported that it would avoid Russia and Belarus in its transport between Asia and Europe. The most important reason was that it did not want to do business with Russian Railways.

RailBridge Cargo recently slightly adjusted this policy by re-opening the northern route for customers that have ‘no other option’. «Companies in Europe (and all over the world) are facing diverse supply chain issues because of the current situation. These issues have a negative impact on production, tradelines, companies, jobs and humans. Some customers have no other option than taking the northern route. We see that customers who used rail freight solutions in the past are now sometimes forced to choose air freight instead to reduce transit times. This has a negative impact on global C02 reduction», the company stated.

Increased transit times

Nevertheless, the focus of the company remains on the Middle Corridor. «It is our goal to support and convince customers to choose this route, due to the Ukraine invasion of Russia and our ethical motivation as a company. Our company is therefore investing in the extension and expanding of these new routes», it says.

According to the logistics firm, the route is becoming increasingly attractive, with improved transit times and quality. «For example, in September a new terminal will be launched and because of that transit times will decrease, and more ferries will be operational», it commented.

Earlier routes

The first route it launched was via Istanbul, crossing only the Caspian Sea and from Baku overland to Turkey. This service, which is still up and running, has as a departure point Xi’an and Zhengzhou, and Duisburg as a destination.

The second route it offered was via the Bulgarian port of Varna. At that time, the company explained that congestion at the port of Constanta was the reason for the choice for the Bulgarian route. The port of Constanta was at that point heavily used for transport from Ukraine. This was also a point of concern for insurance companies, the Bulgarian route was not.

More demand for alternatives

With the growing demand, there was more than enough reason for a third and fourth route, explained RailBridge Cargo. "Most companies today want to avoid Russia and Belarus due to ethical reasons or financial and logistics risks. With this alternative, you can still benefit from rail logistics and avoid Russia and Belarus.

The third route offers two departures per week from Chengdu to Duisburg and Hamburg. "We have found a solution to overcome the congestion in Baku, which decreased transit time from 39 — 41 days to 31 — 33 days. This September, we expect that transit times will decrease even more, with four days due to the extra ferry capacity.