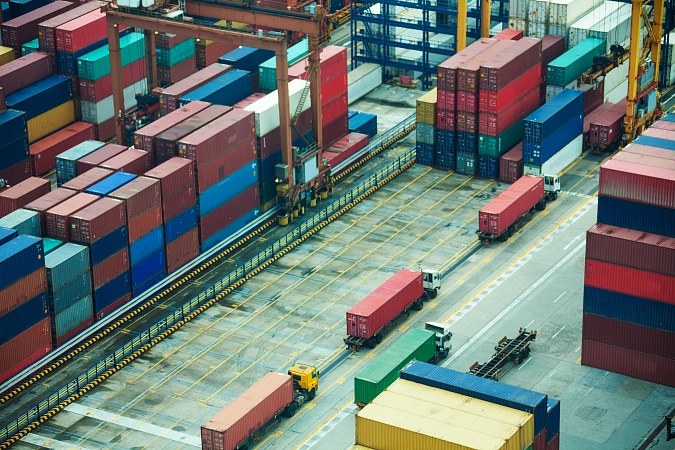

Container shipping operations in south China continue to face significant disruptions due to Covid-related restrictions imposed since late last month, with capacity at Yantian and services to and from its key container terminals still down significantly and knock-on problems persisting at other ports in the area.

The latest update yesterday from container shipping giant Maersk indicates that the slow recovery of operations was continuing at Yantian, but that extensive restrictions and omissions are continuing to affect ocean freight operations throughout the key export area, with many lines continuing to bypass Yantian, its Shenzhen neighbour Shekou, and Guangzhou’s Nansha port.

Maersk noted that «the full impact of the pandemic in Shenzhen and Guangzhou and the ripple effect of the recent Yantian/Shekou/Nansha port congestions may have caused disruptions» for end customers’ supply chains, highlighting that although yard density at Yantian had «reduced to 60%» from around 70% late last week, «we expect continued vessel omissions and vessel delays at Yantian port upwards of 4 days in the coming week».

Meanwhile, it said Nansha yard density had reached 100%, noting that it expected «continued vessel delays at Nansha port upwards of 4-5 days in the coming week». It said export laden container gate-in will be accepted only 7 days prior to vessel ETA, and only after the terminal confirms the advance reservation made by trucking companies for laden containers gate-in.

«Given the heavy yard density of Nansha port, export laden containers gate-in is limited from 21 June until further notice,» Maersk noted.

And the availability of empty containers for exports was also a mounting problem, especially for 40ft units, with Maersk highlighting: «We see 40 GP and 40 HC empty supply is negatively impacted with massive vessel delays and omissions in Yantian and Shekou. Customers are encouraged to amend to 20 GP as an alternative in Yantian and Shekou.»

Maersk said operations in the eastern area of the Yantian terminal — where mother vessels mainly berth — «is gradually recovering to about 54% of its normal level».

However, Maersk yesterday updated customers that due to the disruptions, «90 vessels including our partners’ vessels have omitted the Port of Yantian and Shekou in order to protect schedule reliability. Our people are working relentlessly with the contingency plan which covers 72 vessels for origin export shipments.»

Damage to supply chains ‘already done’

Commenting last week on the wider impact of the disruptions in southern China, the world’s largest container line said that although operations at Yantian are slowly improving, the damage to already-disrupted supply chains had already been done.

Maersk noted: «A few weeks into a very substantial port congestion in Yantian caused by a Covid-19 outbreak, supply chain disruptions continue to be very present in global trade. Productivity is gradually set to increase as more workers return and more berths reopen, but the damage has already been done. The current estimated wait is over a fortnight, causing many carriers to divert vessels to other ports.»

With over 300 sailings from container lines already set to omit Yantian by last week, Maersk noted: «Fighting to get reliability back into operations and services back on schedule after the Suez incident in March, the port congestion in Yantian, with neighbouring ports Shekou and Nansha also affected, is an added pain at a time where global supply chains are already stretched.»