With increasing volumes of cargo being experienced on its LCL and FCL rail freight services between China and Europe, Asia-based international logistics provider

U-Freight Group says that the recent problems in the Suez Canal have made the transport of freight by rail from China into Europe look all the more attractive.

Its observations come as other logistics and freight forwarding groups have also reported strong rises in demand for alternative routings this year to help manage congestion, capacity and ocean reliability issues, with the week-long blockage of the Suez canal prolonging or worsening disruptions to ocean freight supply chains.

Simon Wong, chief executive officer of the U-Freight Group commented: «Clearly supply chain planners are reappraising what was once a completely dominant Suez Canal route from China into Europe, with intermodal rail continuing a sharp upward trajectory in 2021, following on from a strong 2020.

«Although the first China-Europe container freight train was in 2011, it has taken a decade and considerable investment by China’s government to see the route become an established part of logistics networks,» he noted. «The COVID pandemic, and the capacity problems in the air and ocean sectors have pushed the route to much heavier usage, with the recent blockage of the Suez Canal leading to additional traffic.»

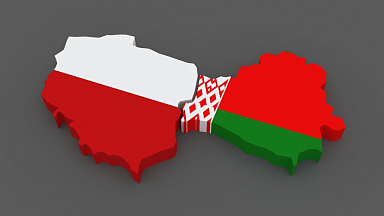

U-Freight started its regular service in 2014, consolidating cargo in Zhengzhou and using the daily service that operates from that railhead to and from Malaszewicze in Poland, Hamburg in Germany, and Liege in Belgium. Last year, it added a second consolidation centre at its logistics hub in Shanghai.

Wong concluded: «We now handle significant consol shipments from China to Germany, Italy, Sweden, Switzerland and The Netherlands in particular, as well as smaller volumes to other European countries, handled by our network of long standing agents once the shipments arrive at the three rail freight hubs on the continent.

«We chose the service from Zhengzhou as it offers a daily frequency, although for FCL shipments our large Chinese presence enables us to arrange container pickup from across the country and select a service from the rail freight gateway that is nearest to our customers. While other transport modes still face significant capacity and schedule issues, our overland rail freight service is clearly demonstrating that it offers a competitive alternative to air freight in regards to price, and considerably faster transit times compared to the ocean freight alternative.»

Typical transit times from Zhengzhou to Malaszewicze are between 12 to 14 days, and 16-18 days to Hamburg.