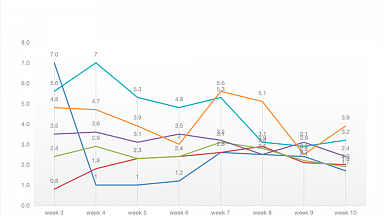

Demand for ocean freight capacity on key trades continues to outstrip supply as peak season heats up, pushing listed Asia-North Europe spot freight rates past the US$13,000/FEU mark, “and sending Europe to South America rates spiking more than 30% since last week”, the latest spot market figures and analysis from digital freight platform Freightos indicate.

That 30% rise in Europe to South America rates this week follows an 18% increase last week, with Freightos speculating that the increase on those lanes are likely to be due to capacity is being diverted to more-lucrative ex-Asia lanes – a trend others have been anticipating in recent days.

Freightos noted that transpacific capacity, in particular, “is so constrained that most bookings – if they can be made at all – are relying on offline bidding wars”, although those have also been a feature for many months on Asia-Europe trades, freight forwarders report – with extra fees such as loading guarantees adding thousands of dollars per feu to shipping costs.

Freight sources report that lines are finding increasingly creative ways of adding or naming such surcharges. For example, Hapag-Lloyd today announced that it will implement a ‘Value Added surcharge’ (VAD) of US$4,000 per 20’ container or US$5,000 per 40’ container for all cargo moving under its regular FAK guidelines ex China to North America. It said the move was “due the continuation of extraordinary demand from China and the resulting operational challenges along the transport chain”.

It said this surcharge “will not affect any mid-term or long-term contracts and is meant to replace some other ad hoc surcharges like the SGF (Shipment Guarantee Fee)”.

The VAD surcharge will be implemented effective 15 August and to be paid under collect basis at US and Canada destinations.

Freightos noted that spot rates from Asia to the US East Coast and the Mediterranean were broadly level this week – although it noted that “planned mid-month GRIs and Peak Season Surcharges could continue to push prices up soon”.

Meanwhile, it reported that Asia to North Europe prices climbed 9% past the $13,000/FEU mark this week, while rates from Europe to the East Coast of South America “spiked by nearly a third to more than $3,000/FEU, likely a result of capacity being diverted to the ex-Asia lanes”.

Freightos noted that Asia-US West Coast rates are still twice their level last July when rates had already started to climb. “And capacity on this lane in particular is so constrained and demand so strong that securing capacity at any price is a challenge, with most bookings relying on offline bidding wars and relationships.”

It highlighted that National Retail Federation data showed that June retail ocean import volumes were down 8% from the record set in May, but were still 19% higher than in June 2019. Volumes are projected to climb to an August early peak of peak season 2021, approaching May’s record – a possible indication that importers are placing orders early to avoid delays of holiday merchandise.

Freightos noted that ocean imports are then expected to ease gradually through November; “but with double-digit percent increases compared to 2019 in each of these months, this decline may not result in a significant reduction in rates or delays”.

And though air cargo rates from Asia to the US and Europe remain about double their typical levels for this time of year on most major lanes, “with ocean rates spiking, a recent IATA analysis shows air cargo is now ‘only’ about six times more expensive than ocean freight, compared with a normal spread of about twelve times. Even at these rates, though, some shippers desperate for inventory are shifting from ocean to air, an indication of how strained the industry is at the moment.”

Disruptive world events

Container shipping analyst Lars Jensen, CEO of Vespucci Maritime, today noted that a recent string of unfortunate global events was continuing to add to bottlenecks in the supply chain and “hindering a reversal to normality”. He highlighted the latest of these, with wildfires in Canada impacting rail services to and from the West Coast port of Vancouver; civil unrest in South Africa shutting down ports, depots and trucking in some places; and another vessel out of action due to an accident. The MOL Charisma, serving ONE’s East Coast 5 (EC5) service, ran aground shortly after departing Vung Tau on 5 July, although the vessel was subsequently refloated and is currently at anchorage in Vung Tau.

“But at least on the positive side, (the) Yantian situation is improving,” noted Jense, highlighting that ONE had stopped its congestion charge for reefers at the south China port.

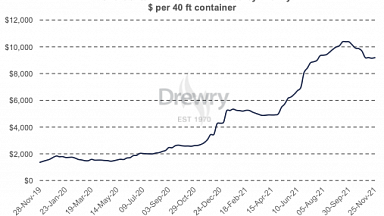

Meanwhile, Drewry’s World Container Index across eight major East-West trades saw its composite index increase 1% or $87 this week, with the index more than four times (+339%) higher than a year ago. The average composite index of the WCI, assessed by Drewry for year-to-date, is $5,871 per 40ft container, which is $3,799 higher than the five-year average of $2,073 per 40ft container.

Spot rates on Shanghai to Rotterdam continue to increase by 1% or $159 and reached $12,954 for a 40ft box. Similarly, spot rates on Shanghai to New York and Shanghai to Los Angeles increased $117 and $102 to stand at $11,825 and $9,733 per feu respectively. Freight rates from Los Angeles to Shanghai grew 2% or $32 to $1,358 per 40ft container.

However, Rotterdam to Shanghai and New York to Rotterdam rates remain stable at their previous week’s level.

Drewry expects rates “to increase further in the coming weeks, but at a slow pace”.