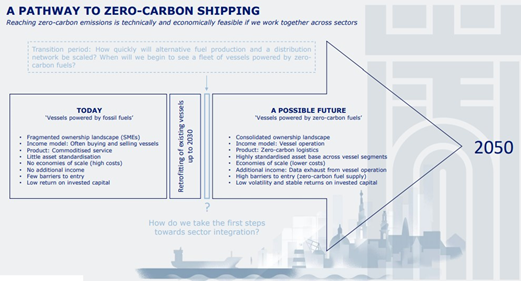

The shipping industry is struggling to identify a clear pathway towards decarbonisation. The asset base is owned by small and medium-sized players. The fragmented industry structure complicates the articulation and development of an industry-wide strategy for zero-carbon fuels. Many initiatives are currently being reviewed. Costs remain a major issue. There is currently no zero-carbon fuel that can offer a global distribution network at scale which is price competitive with current bunker fuels.

The short- and medium-term outlook is shrouded in uncertainty. The industry’s low return on invested capital combined with the increased need to invest has dried up the supply of equity investors and created an environment where there are more sellers than buyers of vessels. We foresee a bumpy transition in the absence of clear long-term guidance from regulators that works to bridge and facilitate the energy transition.

The long-term value play is about reducing the global economy’s CO2

footprint by decarbonising the underlying industries and sectors. To some extent, this means replacing the oil and gas industry, which requires a standardised, scalable and costcompetitive zero-carbon fuel solution that can work across sectors to be identified. The transformation is likely to reshape industries and redistribute value creation.

Shipowners’ access to cargo, capital and ports could be at risk if they are considered not to be doing enough to reduce their CO2 footprint. Their ability to offer a cost-competitive zero-carbon service to their customers will, at some point, be a critical element in the renewal of their licence to operate.

We set out a vision for the future that aims to turn the climate agenda into a business opportunity. The next-generation zero-carbon-fuelled vessels could emerge as an attractive asset class. The route to additional value creation is primarily cost savings through standardisation and economies of scale.

The full version of the article is available here.