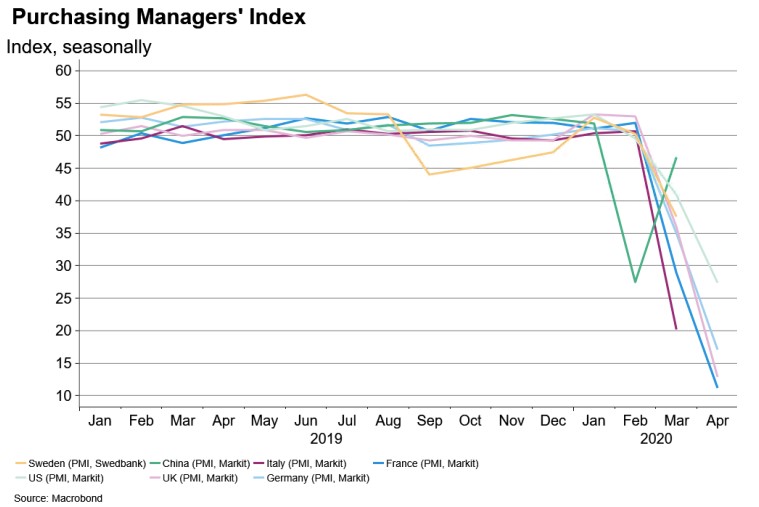

The PMI index is a survey asking senior executives at private sector companies about their prospects for the near future, such as production output, expected orders, hiring and firing etc. In other words, this gives a good indication as to how companies are planning to react to current events, such as the Corona crises. Before the Corona-crises took off in Europe in February, the German PMI index was at 51. This dropped to 35 in March, which the lowest level since the financial crises in 2009. A further drop to 17 was recorded for April, which is by far the lowest reading since comparable data were fist compiled more than 22 years ago.

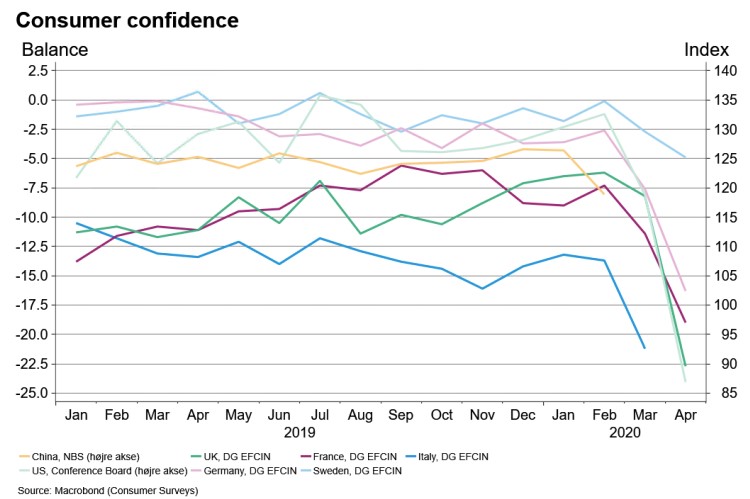

The consumer confidence survey provides an indication of future developments of households’ consumption and saving, based upon answers regarding their expected financial situation, their sentiment about the general economic situation, unemployment, consumption and capability of savings. The figures for Germany show a sharp drop in consumer confidence although not as sharp as in the UK, France, Italy and the US.

Sentiment among German exporters is in free fall. In April, the ifo Export Expectations for manufacturing plunged from minus 19,0 points to minus 50,0 points. Many key German industries are particularly affected, such as automotive manufacturing, mechanical engineering, and electrical engineering. The decline of export expectations in the chemical industry was comparatively moderate in the previous month, but these companies now expect significant declines in export sales. The only bright spot this month was the pharmaceutical industry, which is expecting stable export business.

Adidas who at the beginning of the crisis announced to suspend rent payments has reconsidered these tactics and paid rent on regulary basis. Adidas has received a 3 billion Euro syndicated loans from KfW to bridge the current liquidity crisis and cancelled all dividends and bonusses for 2020. VW Group has started their production at their sites in Bratislava (Slovenia) and Zwickau (Germany) followed by the sites in other countries as of April 28. Lufthansa is grounded and are considering tactical insolvency to reconstruct the company: Asking for 10 billion Euro liquidity credit line but refuses to pay the interest rates nor to open for state ownership of the company. Daimler announced first quarter earnings shrinking from 2.1 billion Euro last year to 2.1 billion Euro — Sales has dropped 17% Coworkers are asked not to apply for holiday leave until further as this will cause drain liquidity dramatically. BMW, who currently also has paused the car production has just placed an enormous order for 5.000 KUKA robots that will be deployed in their mounting line on various sites. For KUKA who has been suffering on liquidity — also before the crisis — this order is a helping hand.