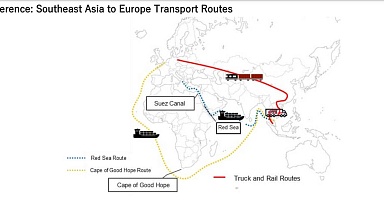

Over the past two months, a sudden surge in Houthi rebel attacks in the strategic Bab el-Mandeb Strait prompted the world’s largest shipping carriers to halt transit through the Suez Canal for several weeks—with even more rerouting their vessels as the United States and Britain launched strikes on Yemen and the situation has escalated. Geopolitical shocks from Red Sea maritime terrorism and the Russia-Ukraine conflict have driven up logistics costs and food prices just as the world economy is struggling to recover from the fiscal pain of the COVID-19 pandemic.

There is precisely one pathway for a world plagued by unpredictable crises to take meaningful collective action —and that is to build more pathways for supply to meet demand. The solution to supply shocks is more supply chains.

China is the one country that has known this—and acted on it—for years. However, it was frowned upon by many Western leaders as a stealth plan to undermine the Western-led international order by placing China at the center of global trade networks.

From a functional perspective, however, the BRI represents what all countries should do in their own national interest.

The need for such hedging became clear in 2021, when the massive container vessel Ever Given ran aground in the Suez Canal, all but freezing trade between Europe and Asia just as the world was seeking to revive trade amid the COVID-19 downturn.

It’s hard to argue that the BRI has not been transformative. Since 2013, about $1 trillion of capital has flowed to BRI member states in construction projects and nonfinancial investments.

Western diplomats and analysts no longer dismiss China’s BRI, but they still don’t fully grasp the underlying context.

Then Western and allied powers began to deploy countermeasures. Myriad programs conceived to cajole countries to borrow at concessionary rates from multilateral rather than Chinese lenders or to contract with Western firms over Chinese ones for 5G networks or internet cables.

The infrastructure arms race is now well underway. China is to be credited for elevating infrastructure on the global agenda after decades of neglect by Western powers.

The ability to spontaneously shift shipping from the Suez Canal to Eurasian railways or even faster Arctic maritime passage is precisely how the global economy can become more resilient to shocks. On this basis alone, an infrastructurally hyperconnected world is both desirable and superior to our present system.

It is also essential for civilizational survival as climate change accelerates. Climate stress will likely spur the migration of a billion or more people this century. So, building the requisite urban infrastructure is vital. These investments are part of the great global recycling that fuels the world economy.