The Covid-19 outbreak and its dramatic consequences have cast a fresh light on the importance of maintaining resilient food supply chains.

With no concerns of food shortage, the EU agri-food sector has so far responded remarkably well to challenges of historical magnitude. Thanks to sustained food demand, EU agriculture has suffered relatively less damage compared to other parts of the economy which are being more affected by lockdown measures.

There have been, however, specific impacts and certain agricultural sectors have been hit more severely than others. Beyond labour issues and logistical bottlenecks, the EU food supply chain has to continue adapting to rapid changes in demand, with strong uncertainties on the duration of the crisis and the recovery path in the EU and globally.

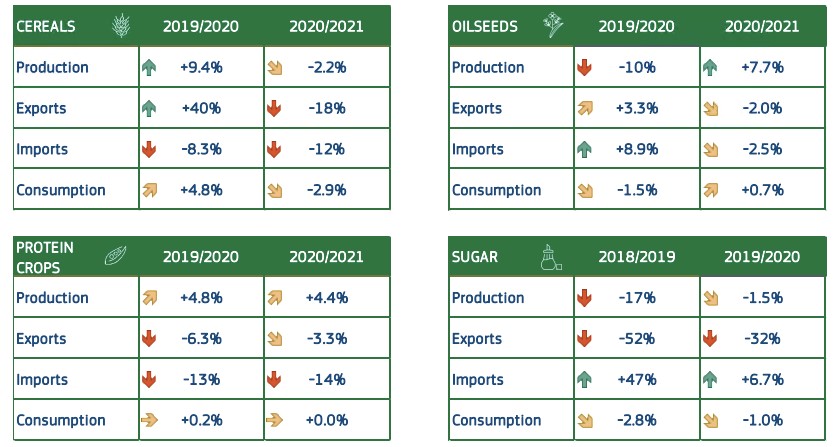

In the grains and oilseeds market, ample global stocks, sizeable 2019/2020 harvest in the EU and neighbouring countries, and good prospects in the Americas for the next crop should allow a satisfactory supply of the market in the coming months.

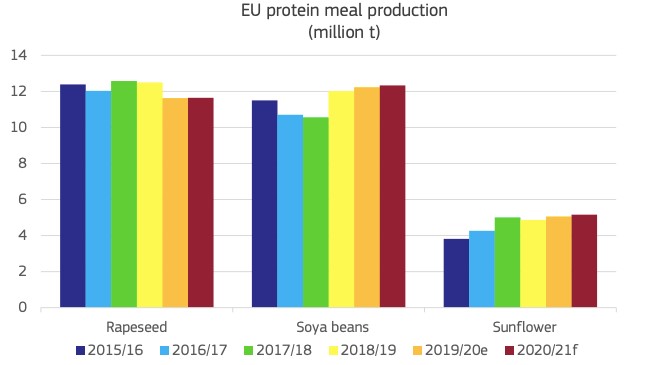

In the oilseeds market, a decrease in EU rapeseed production and reduced demand for oilseeds, linked to a decline in biofuels demand due to low oil prices, could result in an overall lower supply of proteins.

In the sugar market, very low energy prices and lower demand for gasoline push ethanol production down, and more white sugar is expected to be produced instead of ethanol. With higher global supply than anticipated, world sugar prices dropped.

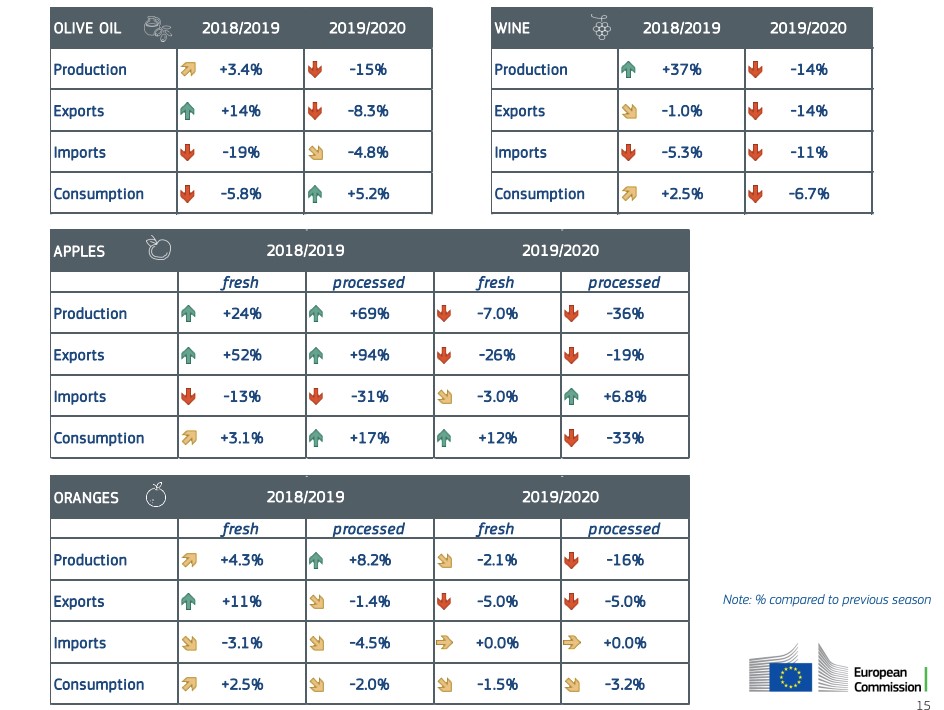

In the olive oil market, availabilities should remain high as an average production is expected, combined with a high level of beginning stocks. Due to stockpiling, some demand recovery could be expected in the main producing EU countries, but consumption in the non-producing EU countries is likely to decrease.

In the apples and oranges markets, no Covid-19-related production impacts are expected in the current marketing year. Demand for less perishable fruits like apples and oranges is strong.

In the wine market, on top of Covid-19 challenges resulting in declining exports, US tariffs remain an important challenge. Confinement measures could also affect EU consumption negatively.

In the dairy market, the coincidence of the spring peak of production in the EU with the Covid-19 outbreak exacerbates the downward price impact and could favour the production of more storable and less labour-intensive dairy products (milk powders) over others. The closure of foodservice and outdoor/farmers’ markets negatively affects some high-value added products (e.g. PGI/PDO cheeses). On the other hand, other dairy products could benefit from increased retail sales.

In the meat market, the switch from foodservice to home consumption and the capacity of retail to market additional meat products may influence production, particularly for beef and sheep meat that are more negatively impacted. Despite high prices, pigmeat production growth will be limited by environmental restrictions and remaining African swine fever risk. Due to the Covid-19 crisis, the transport of live animals could be restricted.

The particularly severe impact of the Covid-19 crisis on the flower and nursery sector, not covered in this report, needs to be mentioned, with a range of factors: most outlets have been closed (except retailers and nurseries in some EU countries), Easter was one of the three demand peaks in the year, and air freight has been halted.