China’s industrial economy bounced back strongly in April after the first quarterly contraction in history, but retail and investment remained weak, as demand concerns persisted.

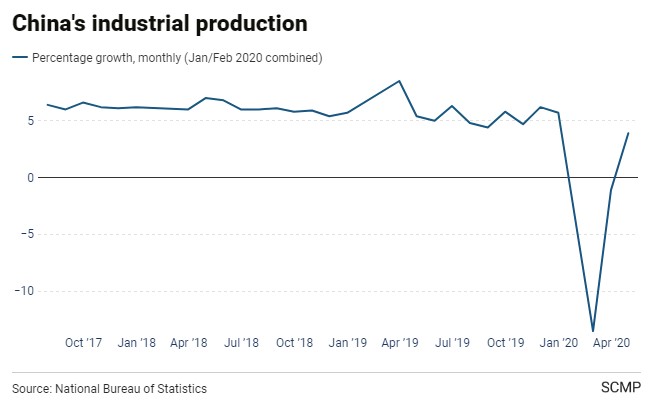

Across the board, monthly data released on Friday was improved from March, with industrial production, retail sales, fixed asset investment all kicking on. However, with weak demand at home and abroad, China’s efforts to get the economy back to full speed are likely to remain slow, analysts have said.Industrial production, a measurement of output in China’s manufacturing, mining and utilities sectors, grew by 3.9 per cent from a year earlier, following a 1.1 per cent contraction in March. This was much better than the median result of a Bloomberg poll of analysts, which predicted 1.5 per cent growth.

In the first quarter, this vital part of the Chinese economy shrank by 8.4 per cent compared a year earlier. April’s improvement was led by a 5.0 per cent growth in manufacturing from a year earlier, much improved on a 1.8 per cent drop in March.

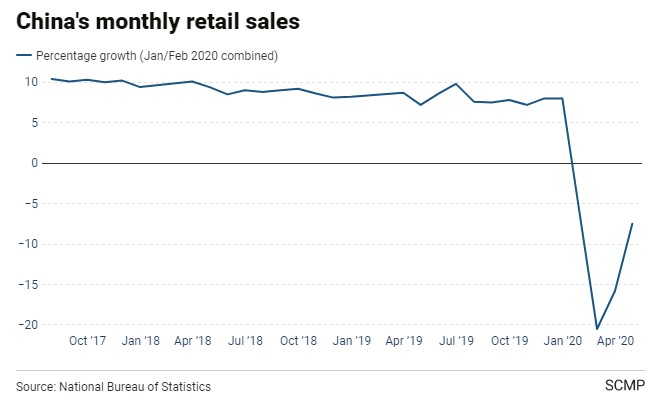

Retail sales, a gauge of consumer spending in the world’s most populous nation, fell by 7.5 per cent compared to April 2019. This was much improved on March’s 15.8 per cent drop, which helped drive a 19.0 per cent collapse in spending in the first quarter. It was worse than analysts’ forecasts of a 6.0 per cent drop.

Fixed asset investment, the value of spending on real estate, infrastructure and capital equipment, fell 10.3 per cent in the first four months of the year compared to a year earlier, an improvement on the 16.1 per cent drop in the January-March period and slightly worse than the Bloomberg poll, the median forecast of which was minus 10 per cent.

Investment in the manufacturing sector fell by 18.8 per cent over the first four months of the year, with infrastructure investment down 11.8 per cent and property down 3.3 per cent.

The surveyed jobless rate was 6.0 per cent in April, up from 5.9 per cent in March but better than the all-time high of 6.2 per cent in February. However, while this is an indicator of the unemployment rate in a certain segment of the economy, it is not viewed as an accurate depiction of the overall employment situation.

is improving following a weeks-long shutdown at the start of the year, but that significant challenges remain.

«The entire economy has not returned to the level of previous years,» said Liu Aihua, spokeswoman for the National Bureau of Statistics, at a press conference on Friday. «The economy in April continued the trend of recovery in March, but the improvement was just compensatory to some degree.

Demand is likely to be drained from overseas markets, meaning the export boost enjoyed in April — powered by shipments of medical supplies — is expected to be short-lived. An enormous 46.3 per cent drop in South Korea’s exports over the first 10 days of May, largely due to collapses in shipments to the United States and Europe, suggest that China’s exporters will have a tough few monthsahead.

And while industrial production has bounced back reasonably strongly, producer prices have fallen to a four-year low, it was announced on Tuesday, suggesting manufacturers are unable to charge what they would like for the products they make.

Most businesses have reopened, according to various trackers, but capacity issues persist.

«The vast majority of businesses in China have at least turned the lights back on — with 98 per cent of large companies having resumed operations,» read a report from Trivium China, a Beijing-based economic consultancy.

«29 provinces are reporting full resumption rates for large businesses. These provinces account for 95.2 per cent of gross domestic product. That said, capacity utilisation at many of these companies is still closer to 85 per cent of normal levels, with many far below that.»

Poor retail sales were telegraphed by weak consumption over the Labour Day holiday on May 1, with retail 6.7 per cent below the same holiday last year, with catering and accommodation revenues at around 70 per cent of the 2019’s levels.

Furthermore, service sector purchasing managers’ indices for Aprillagged those of the manufacturing sector, suggesting the industrial economy has bounced backed much more quickly.

«China’s economy continued to recover in April after the sharp contraction in February,» said Louis Kuijs, an analyst at Oxford Economics. «As expected, household consumption momentum remained the weakest link but it also improved substantially in April.»